CREDITO NETWORK

Nowadays, as our world is constantly becoming more and more advanced in every aspect, and blockchain technology has and will become even more significant part of our lives, in parallel with that the whole banking and transaction system hasn't changed that much.

Creators of CREDITO NETWORK, a decentralized global financial decisioning platform, have come up with a solution. They focused on the main problems that have affected the banking world which are:

1.security problems such as credit card frauds and stealing valuable data from its user

2.people who have no credit scores are put in a more difficult position which disables them from the use of certain benefits given by the banks

3.keeping all the information and control centralized

4.unadjusted and outdated systems which are not compatible and do not show actual state

2.people who have no credit scores are put in a more difficult position which disables them from the use of certain benefits given by the banks

3.keeping all the information and control centralized

4.unadjusted and outdated systems which are not compatible and do not show actual state

Stating concisely only the main problems, anyone can see that this system is in need of drastic change. CREDITO has managed all that. It has introduced us with great solutions to all of these issues and has shown a way to improve and revolutionize the whole transaction world.

As we mentioned, CREDITO NETWORK or short CREDITO, is a blockcain technology etherum based platform which brings decentralization into the global finance. It makes transactions as safe as possible, enables financial inclusion and decentralized lending, gives accurate credit scores and much more. For more information about the stated, you can visit their Official website https://credito.io/ .

Credito will provide bank and other financial institutions access to all of needed credit data and scores, whether it is about a legal entity or a physical person. Credito is totally transparent and can provide all the necessary information because it can be subjected to inspection at any time, when needed. Also, all of the activities of the users are being monitored to prevent any abuse or misuse.

CREDITO NETWORK, along with its transparency and security, brings out smart contracts via its loan agreement, which make all of transactions visible, traceable and clear with no need for central authority to medley. These contracts are flexible and can handle various ERC-20 compatible tokens.

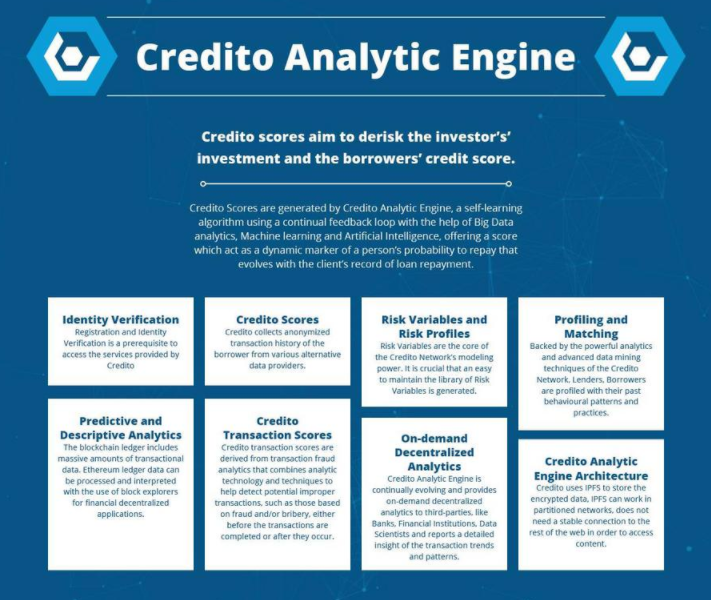

CREDITO NETWORK has introduced three segments of this platform:

1.CREDITO SCORE - contains all information about a subjects probability to repay a loan amount

2.CREDITO TRANSACTION SCORE - contains all information about a fraud occurring probability

3.CREDAPP – decentralized P2P crypto lending platform

2.CREDITO TRANSACTION SCORE - contains all information about a fraud occurring probability

3.CREDAPP – decentralized P2P crypto lending platform

Regarding token distribution, CREDITO NETWORK will have a one-off „TGE“ or Token Generation Event, where 50% of tokens will be available for public sale. The date of „TGE“ will be announced in the near future and it will allocate a total Credits supply of 1 billion, as shown in the picture below.

Detailed information about the whole project you can find on CREDITO NETWORK White paper https://credito.io/pdf/whitepaper.pdf .

Also, everything you need to know about the brilliant team members and creators of CREDITO NETWORK, is listed on their Official website https://credito.io/ .

The Author: Minato04

Bitcointalk Profile link: https://bitcointalk.org/index.php?action=profile;u=2219479

ETH: 0x5ce829498ba0a2A750bA3cfbbCE664Bc6b8eAd9F

Komentar

Posting Komentar