INSCOIN: the first insurance company to combine the real world with the digital world using Blockchain technology

Blockchain technology is very important for insurance companies in the following ways. This saves customers from illegal activities due to decentralization. Also increase the company's cash flow, eradicate the delay in the amount to be paid under the contract signed by the client. Also help brokers, instantly receive commissions.

The KNOX project will be the first insurance company to incorporate the world of newcomers with blockchain technology, to create certification and insurance policies.

What is an InsCoin Project?

The KNOX Project will be the first insurance company to combine the real world with the digital world using Blockchain technology, creating the most efficient and sophisticated structure in the sector, to find solutions to certification and anti-counterfeit insurance policies, as described above.

The KNOX Project will be the first insurance company to combine the real world with the digital world using Blockchain technology, creating the most efficient and sophisticated structure in the sector, to find solutions to certification and anti-counterfeit insurance policies, as described above.

"InsCoin for Knox Project" aims to establish the first insurance company to receive Crypto (INSC) for insurance premium payments, and the first, with the help of blockchain, will solve the problem of counterfeiting insurance policies.

With smart contracts, the spread of fake insurance policies is avoided because it is the same system that issues them upon receipt of payment.

The INSCOIN project intends to use, among many available, the Ethereum blockchain, which currently presents the largest number of real cases in use and the service economy and transactions currently in operation. Ethereum provides, using ERC20 infrastructure and technology, the creation of digital personalized coins from token publishing that allow to support entrepreneurial projects. Token sales allow the company to gather the necessary economic resources for project development where the token itself will play a key role. Token in this sense allows the possibility of new technologies that offer innovative services.

KNOX's goal is to achieve, by utilizing blockchain, the decentralization of the entire insurance system. Decentralization means the transformation of traditional insurance policies from paper into smart contracts.

How does InsCoin work?

This new project is under development and used for the ICO Knox Project. And the whole project was developed to help improve customer relationships with total and full transparency. There is a lot going on with the new company, and there is quite a lot of information on the company website. Not only that, but the information on the website is broken down into several different sections, all of which are easy to navigate through and give you everything you need to learn about coins.

This new project is under development and used for the ICO Knox Project. And the whole project was developed to help improve customer relationships with total and full transparency. There is a lot going on with the new company, and there is quite a lot of information on the company website. Not only that, but the information on the website is broken down into several different sections, all of which are easy to navigate through and give you everything you need to learn about coins.

How can Blockchain change the insurance industry?

- To customers

Smart contracts prevent the spread of fraudulent insurance policies, since it is the same system that will be issued

once payment is received. - The customer has full control over the insurance policy.

- Subscribers can access all WEB services and mobile platforms and check their policies.

- For insurance companies

With smart contracts, there will be no delays in premium collection, achieved by increasing the company's cash flow. - Thanks to Blockchain, fraudulent policies will never be passed on to the company.

- Blockchain enhances business processes and ensures a truly unshakable security system.

- For brokers

Get credibility for policyholders and beneficiaries. - Direct control over its administrative reports.

Immediate commission allocation.

In insurance, how payment is made or what is actually paid is a complicated subject. In the KNOX platform, this issue simply does not exist. INSCOIN Token, a cryptocurrency based on Ethereum ERC20 technology, is used for every payment on the platform. It is goodbye to unfinished insurance claims or late payments since the smartest contracts of ethereum technology reached by insurance companies and insured, executing the terms of the insured agreement immediately make the payment. Users can not be fooled, no matter who they are dealing with.

INSCOIN => This is the crypto currency that will be used for each activity or transaction at https://www.inscoin.co/ Insurance Company.

Info Token

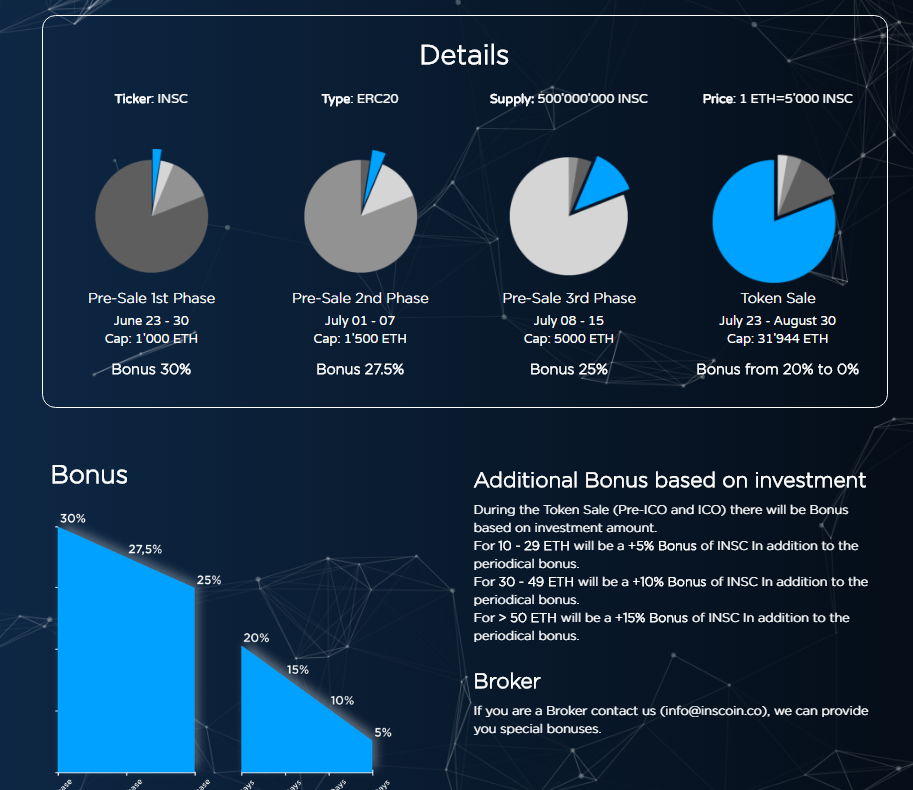

Token - INSC

Platform - Ethereum

Type - ERC20

PRICO price - 1 INSC = 0.0002 ETH

Price at ICO - 1 INSC = 0.0002 ETH

Pre-ICO begins - June 23, 2018

Pre-ICO ends - July 7, 2018

Platform - Ethereum

Type - ERC20

PRICO price - 1 INSC = 0.0002 ETH

Price at ICO - 1 INSC = 0.0002 ETH

Pre-ICO begins - June 23, 2018

Pre-ICO ends - July 7, 2018

Bonus - Available

Investment info

Min. investment0.1 ETH

Receive - ETH

Distributed in ICO - 54%

Soft cap - 4,000 ETH

Hard cap - 39,444 ETH

Receive - ETH

Distributed in ICO - 54%

Soft cap - 4,000 ETH

Hard cap - 39,444 ETH

Token on sale - 270.000.000

Unallocated tokens will be burned after the ICO ends

Unallocated tokens will be burned after the ICO ends

INSCOIN tokens are a fundamental part of our project. Through it the customer can pay the insurance premium and can access the maximum level of authenticity of the policy, receive it in the form of smart contract.

CURRENT DISTRIBUTION

54% of total bids are allocated for token sales

15% Distribution to wholesale trade

10% is allocated to teams and advisors

10% Distribution of network partnerships

9% is allocated to the company

2% is allocated to Airdrop and Bounty

15% Distribution to wholesale trade

10% is allocated to teams and advisors

10% Distribution of network partnerships

9% is allocated to the company

2% is allocated to Airdrop and Bounty

FINANCING DISTRIBUTION

60% is allocated for the manufacture of insurance companies

20% for platform development

10% is allocated for marketing

10% is allocated to backup

20% for platform development

10% is allocated for marketing

10% is allocated to backup

Roadmap

Realization of study project (MARET 2017)

Team Building

Establish the first collaboration network

Team Building

Establish the first collaboration network

Business Plan Forecasts (MEI 2017)

Legal consultation

Invest € 150,000

Legal consultation

Invest € 150,000

IT Insurance licensed platform (JULY 2017)

Invested € 300,000 for certified insurance platform

Invested € 300,000 for certified insurance platform

Insurance partnership (OCTOBER 2017)

Partnership with over 300 insurance brokers ready to work with the company

Partnership with over 300 insurance brokers ready to work with the company

ICO Planning (FEBRUARY 2018)

ICO planning and marketing plan development

ICO planning and marketing plan development

PRE-ICO (JUNE 2018)

Starting from PRE-ICO

Starting from PRE-ICO

ICO (JULY 2018)

Starting from ICO

Starting from ICO

Trading inscoin at major exchanges (SUMMER 2018)

InsCoin will be listed on the main exchange to ensure easy implementation for the company's future customers and the exact volume compared to our revenue.

InsCoin will be listed on the main exchange to ensure easy implementation for the company's future customers and the exact volume compared to our revenue.

Compliance to obtain an insurance license (AUTUMN 2018)

We will get authorization from the authorized authorities of the three countries to provide legal insurance services.

We will get authorization from the authorized authorities of the three countries to provide legal insurance services.

Introduction to internal platform (WINTER 2018)

With that customers will be able to access their policies through smart contract.

With that customers will be able to access their policies through smart contract.

Smart contract in insurance business (WINTER 2018)

Smart contracts will increasingly become the protagonists of the insurance industry.

Smart contracts will increasingly become the protagonists of the insurance industry.

Team

Partners

For more information:

Website: https://inscoin.co/

Telegram: https://t.me/inscoinico

Linkedin: https://www.linkedin.com/company/inscoin-holding-ou/

Twitter: https://twitter.com/inscoinforknox

Facebook: https://www.facebook.com/Inscoin-for-Knox-1802470656458272/

Reddit: https://www.reddit.com/r/InsCoin/

Telegram: https://t.me/inscoinico

Linkedin: https://www.linkedin.com/company/inscoin-holding-ou/

Twitter: https://twitter.com/inscoinforknox

Facebook: https://www.facebook.com/Inscoin-for-Knox-1802470656458272/

Reddit: https://www.reddit.com/r/InsCoin/

Author: (Minato04)

Komentar

Posting Komentar